Is Harrisburg PA Heading for Bankruptcy?

A story close to home on the financial problems of municipalities and states. My state capital, Harrisburg PA, is having some problems servicing its debt and it’s controller has recommended that it skip a $ 2.2 million debt service payment and consider bankruptcy.

It’s hard to attribute this problem entirely to the economy however as this one seems to just be about a series of blunders. The Harrisburg Authority, which oversees a garbage incinerator, apparently issued some debt to repair and upgrade the incinerator in the hopes that usage fees would be sufficient to cover debt service. Apparently, the authority’s credit rating wasn’t so good, which meant that the city had to guarantee the bonds with Dauphin county having to also provide a secondary guarantee on the bonds because Harrisburg’s financial condition wasn’t so strong either. Well, it turns out that the authority nor the city had the money to cover debt service and county had to do a “make good” on a missed payment and is now suing the city to recover its money. Harrisburg faces $ 68 million in debt service payments with no hope of the incinerator generating enough cash flow to meet its obligations as the incremental usage fees it was expecting have never materialized. According to the Patriot News, the city may not be able to meet payroll this month and it’s going to be hard pressed to raise money inexpensively as its bond rating has been cut to junk status.

One thing my daddy always told me was to never co-sign on a loan for anyone. Now my dad wasn’t a high finance type, but that’s nevertheless sage advice that I’m sure that Harrisburg and Dauphin county wish they had gotten. Again, I have mixed feelings on privatization, but these guys apparently were deceiving themselves if they thought they could run a business. In this case, it probably would have been better to privatize the entire thing and collected some sort of usage fee from the contractor. As it is now, it looks like the taxpayers are going to be on the hook while being beleaguered themselves already with whatever else they may be dealing with from the Great Recession.

The Great Recession is not allowing a lot of margin for error and the fallout from bad decisions are certain to be aggrandized in this environment. The tide has come in and we’ll be continuing to see who was swimming in the buff as time goes on.

They will probably -as a single entity- be better off to file for bankruptcy, however, this is another nail in the coffin of states’ credibility.

I am sorry to hear this news about Harrisburg.

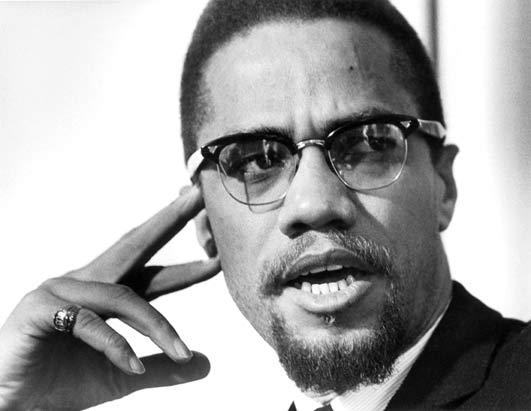

I had been telling people about my research about nearby York PA. They were celebrating the fact that the city had just elected a Black female president as mayor. They pointed out the fact that it was also the scene of a police shooting of a Black person years ago.

Some people just can’t seem to shake their worship of “Portraits On The Wall” and make note of the serious issues that they face regardless of whom is in power.

CF,

It’s funny that you mention the changing of the guard in York. The same thing just occurred in Harrisburg with the election of the first African-American female mayor–just in time for this mess. They ain’t gonna have a lot of time to worship portraits, particularly with the possibility that folks might have to dig deeper in their pockets to cover the shortfalls here.

The majority of Harrisburg’s population is African-American and for a city of under 50,000 folks, they’ve got a huge crime problem, so huge that the local NAACP has called for martial law to get things under control:

http://www.pennlive.com/midstate/index.ssf/2009/06/harrisburg_chapter_of_naacp_ur.html

Again, this is a fairly small city by most standards, so the new mayor certainly has her hands full between the street pirates and impending bankruptcy.

Crisis:

Bankruptcy is a viable option versus having to sell off the city’s jewels to raise capital for something that very well might be discharged pursuant to bankruptcy. I’d guess that the county would likely wind up being saddled with the debt since they’re a secondary guarantor on the bonds and it’s almost certain that they’ll figure out a way to shift the obligation to the state. So bankruptcy is probably just going to be a game of musical chairs shifting the problem from Harrisburg taxpayers to everyone in the state.

Yes, considering that this is the capital of our fair state where the legislators go to do their business, this is embarrassing and certainly impacts on credibility.